Annual Corporate Housekeeping You Can't Sweep Under the Rug

- fallonesv

- Jan 15, 2019

- 1 min read

Updated: May 13, 2020

Originally written by Katelin Kennedy

There’s nothing like that new year motivation to get your business organized in January. You probably have a giant to-do list (or two) of action items to grow your business this year, but we wanted to remind you about a few action items you can’t afford to skip.

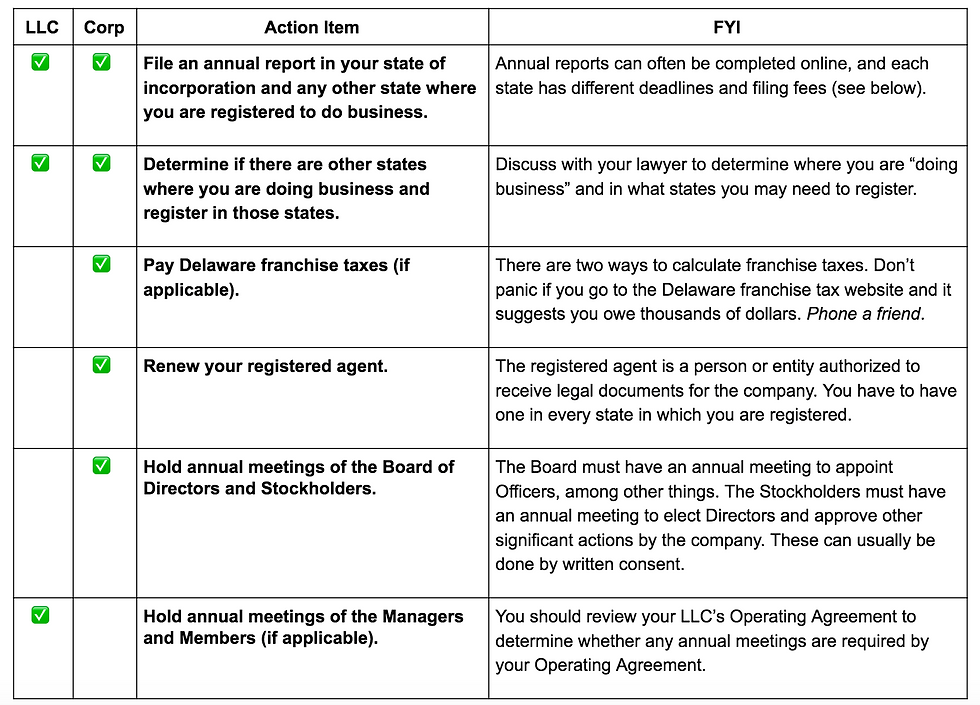

Here’s a breakdown of the corporate housekeeping that should be on your to-do list, and important deadlines to add to your calendar now so you don't get stuck paying avoidable late fees.

Annual Corporate Requirements

Deadlines & Late Fees

Delaware annual reports and franchise taxes are due by March 1st.

Late Fees: $200 penalty, plus 1.5% interest per month after due date.

North Carolina annual reports are due by April 15th for most companies.

There are no late fees, but you’ll get a notice of pending dissolution or revocation of registration if you fail to file, and no one wants to get that kind of notice in the mail.

California annual reports are due each year by the last day of the month in which the corporation was incorporated or registered to do business in California.

Late Fees: $250 penalty

We know that you have more exciting things to focus on, so we'd be happy to help with your corporate housekeeping this year. Don’t wait for spring, or you may end up paying avoidable late fees. Contact us for more information!

*This blog provides general information for educational purposes only. It is not intended to constitute specific legal advice and does not create an attorney-client relationship.*

Comments